Qualifications & Information

Minimum 18 years of age

(20 years of age for Correctional Officer)

(21 for CLEET Certified Correctional Officer)

High school diploma or GED

Valid driver’s license

U.S. citizen or immigrant with lawful status

Clean drug screen and background check

No felony or domestic violence convictions

Must not be on active duty in the military

Honorable discharge from the U.S. Armed Forces

Must not be on probation for any criminal offense

No pending charges for any criminal offense

No outstanding warrants

Ability to pass the ODOC physical agility

Physical Agility Test (PAT)

Applicants are required to participate, and pass, a physical agility test, prior to hiring. The timed exercises will include push-ups, plank, squats, lunges, flexibility, stair climbing, and a half-mile run.

This test is designed to evaluate your ability to safely complete defensive tactic techniques, including: strength training, security techniques, use of pressure points, weapons defense, employee survival, riot control, restraint tactics, weapons retention, and firearms qualification.

See video link for exercise demonstrations.

Benefits

Potential career growth abounds with the Oklahoma Department of Corrections

HEALTH/DENTAL INSURANCE

Several plans are available based on your geolocation.

BASIC LIFE INSURANCE

Your plan includes a $20,000 life insurance policy. If the death is accidental, the amount doubles. Additional coverage is available at extra cost.

DISABILITY INSURANCE

Short- and long-term disability is provided to employees when off work due to a qualifying event. Disability coverage pays 60% of the employee’s salary up to a maximum dollar amount.

Employees are allotted a specific amount each month above their base salary rate to “purchase” core benefits. The benefit allowance is higher for employees who also have dependent coverage. If the cost of the Employee’s selections total less than the monthly allotment, the remaining money is included as taxable income in the employee’s take-home pay. If the selections total more than the benefit allowance, the employee must pay the difference.

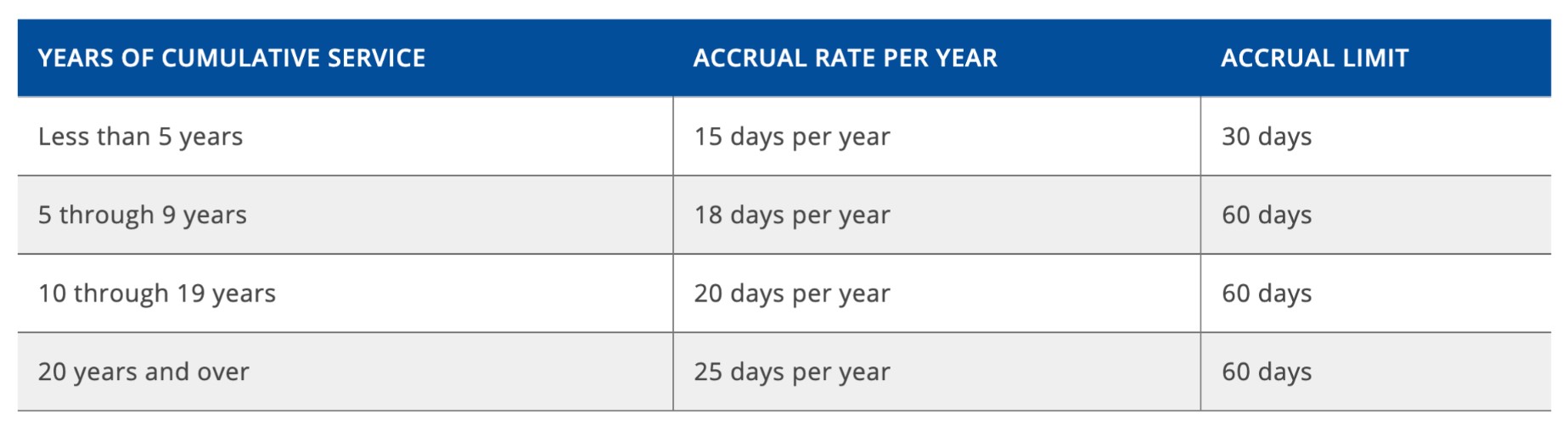

Annual Leave

Annual leave is accrued based upon years of continuous service and is utilized for vacations, personal business, and time off not covered by other paid or holiday provisions.

Sick Leave

Sick leave is to be used when an employee is unable to work due to illness or injury, or for medical, dental, or optical examinations or treatment. Full-time employees accrue 15 days per year. There is no accumulation limit.

Family Medical Leave

Employees with at least 12 months of service who have worked at least 1,250 hours in the preceding 12 months may take family leave, not to exceed 12 weeks in a 12 month period for qualifying events. Family leave is deducted from existing leave balances or may be taken as leave without pay.

Leave Sharing

Permanent employees with more than 12 months of service who have exhausted accrued sick and annual leave and are absent from work because they suffer from, or have a relative or household member who suffers from, a serious, extreme, or life threatening illness or injury, and who are eligible for family leave, are eligible to receive annual or sick leave donated by state employees.

Military Leave

Employees are eligible for paid military leave for a period of 30 days per federal fiscal year when ordered to military duty or service.

Organizational Leave

Qualifying employees are entitled to take leave with pay up to three days a year to attend meetings of job-related professional organizations of which they are a member.

An additional benefit the state offers to eligible full-time employees is longevity pay, based on the employee’s years of service. The full amount below is payable in one lump sum annual payment:

2-3 years of service = $250

4-5 years of service = $426

6-7 years of service = $626

8-9 years of service = $850

10-11 years of service = $1,062

12-13 years of service = $1,250

14-15 years of service = $1,500

16-17 years of service = $1,688

18-19 years of service = $1,900

20-21 years of service = $2,000

Each additional two years, add $200

Premium Conversion

Employees may elect to pay for qualifying mandatory and optional coverage before taxes are deducted, lowering their taxable income.

Reimbursement Accounts

Employees may set aside money from their paycheck before it has been taxed to pay for planned expenses, such as medical deductibles and child care expenses.

Training

All employees, other than temporary, are provided pre-service and ongoing in-service training, along with staff development programs that prepare employees for the responsibilities of their new positions, help them acquire the skills and acknowledgment required for excellence and career advancement, and help them assume leadership positions within the department.

Voluntary Payroll Deductions

Payroll deductions are available for all employees to a variety of insurance organizations and unions/associations. Check with your personnel representative for the latest listing.

Charitable Contributions

All employees, other than temporary employees, can contribute through payroll deductions to a variety of fully accountable private nonprofit, social, health and welfare charitable organizations.

CAREERS

with ODOC Team Oklahoma